SSI Payments and a Government Shutdown: What Happens to Your Check and Benefits

The news cycle, predictably, ignited on October 1st. The U.S. government is shut down, a familiar political impasse resulting from a failure to pass a funding bill. The immediate public reaction, a quantifiable surge in online search traffic and panicked news segments, coalesced around a single, primal question: will my Social Security check stop?

The answer is a simple, data-supported no. But that answer, while correct, is also the most misleading piece of information you will hear this week.

The mechanics are straightforward. Social Security and its disability counterpart, SSDI, are funded through what is known as "mandatory spending." Their payment authority derives directly from the Social Security Act, a piece of legislation that exists outside the annual budgetary cage fight that causes these shutdowns. Max Richtman of the National Committee to Preserve Social Security & Medicare correctly stated, "The system hasn't missed a payment in its entire 90-year history and won't start now." Wayne Winegarden of the Pacific Research Institute echoed the sentiment. They are both right. The 74 million Americans (with nearly 6.8 million in California alone) who rely on these payments will see the funds deposited into their accounts on schedule.

This is the point where the cable news analysis usually ends. It’s a comforting factoid. It is also a dangerous oversimplification. The real story, the one buried in the appendices of the Social Security Administration's (SSA) contingency plan, is not about the cessation of payments but the degradation of the system that delivers them. The threat is not a sudden stop, but a slow, corrosive seizure.

The 12% Illusion: When "Open" Means Functionally Closed

The Friction of a Skeleton Crew

Let’s look at the numbers. The SSA will remain open, but it will do so with a significantly diminished workforce. According to its own planning documents, approximately 45,000 employees are deemed "excepted" and will continue to work. However, about 12% of the workforce will be furloughed—to be more exact, 6,200 of the SSA’s roughly 51,200 employees are now at home.

A 12% reduction in force may seem manageable on a spreadsheet. In operational reality, it’s a critical failure point. The agency has published a list of services that will be suspended for the duration of the shutdown. This is where the true cost becomes apparent. While you can still apply for benefits or report a death, the SSA will cease processing benefit verifications. They will stop working on earnings record corrections. They will not issue replacement Medicare cards.

I've analyzed hundreds of corporate and government contingency reports, and the language is always clinically detached. But the operational impact of suspending "benefit verifications" is anything but. It means a senior trying to get into subsidized housing can't produce the required proof of income. A family trying to correct a deceased parent's earnings record to receive proper survivor benefits is put on indefinite hold. These aren't administrative trifles; they are acute, personal financial crises manufactured by a political deadlock. The check may arrive, but the human support system that adjudicates, verifies, and corrects the complex issues of millions of lives has been partially dismantled. The `ssa` is technically open, but its capacity is crippled.

The problem compounds from there. The annual Cost-of-Living Adjustment (COLA), a vital inflation hedge for beneficiaries, is scheduled for an October 15th announcement. That announcement now may not happen on time. It relies on data from the Bureau of Labor Statistics, another agency whose operations have been halted. This is a clear example of systemic contagion. One shuttered agency infects the operations of another, with the financial uncertainty passed directly down to the public.

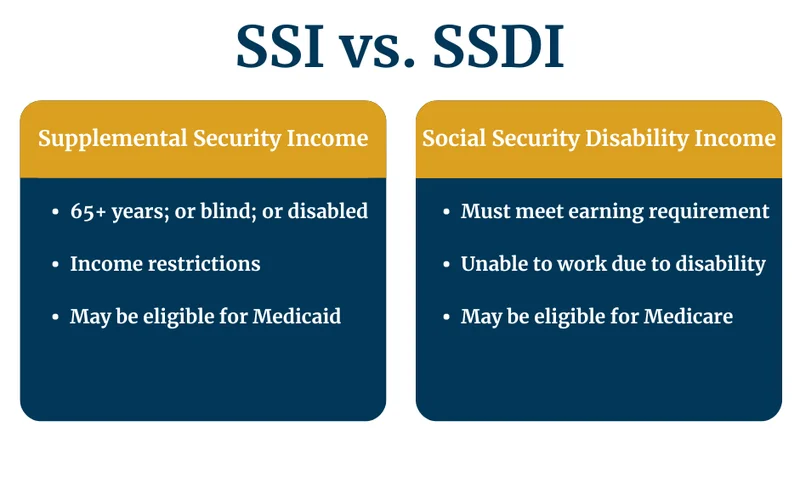

The distinction in funding mechanisms creates further confusion and risk. Supplemental Security Income, or `ssi`, is a different animal from Social Security. It is funded by annual appropriations. While experts believe funding is secure through December, it operates on a shorter leash. A prolonged shutdown, like the 35-day event in 2018-2019 that the CBO estimated cost the economy $11 billion, puts programs like `ssi disability` in a much more precarious position than the core Social Security trust. The same goes for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), which is expected to exhaust its funding rapidly. SNAP benefits will be paid for October, but beyond that, the data becomes murky.

This leads to a methodological question about the shutdown itself. How, precisely, does the government determine which 12% of the SSA workforce is "not excepted"? The designation implies their work is non-essential for the core mission of benefit payment. Yet the suspension of services like overpayment processing and FOIA requests suggests that the definition of "essential" is narrowly, perhaps politically, defined. It prioritizes the optics of a delivered `ssi check` over the functional integrity of the agency itself. The result is a Potemkin agency: the lights are on, payments are flowing, but the crucial work of maintenance, correction, and public service has ground to a halt. The `ssi office` may be open, but the person you need to speak with has been sent home.

The public anxiety, the "big concern from residents" that news outlets report, is therefore both misplaced and entirely justified. It’s misplaced in its focus on the binary question of whether the `ssi payment` will arrive. It is entirely justified in sensing that the system is under a severe, debilitating strain. The government is asking its most vulnerable citizens—those navigating the complexities of disability, retirement, and poverty—to interact with a system that is now officially, deliberately, and functionally broken.

A Calculated Erosion

The core analytical error is viewing this shutdown as a simple on/off switch. It is not. It is a calculated degradation of service. The guarantee of Social Security payments acts as a political shield, allowing lawmakers to claim they have protected seniors while they simultaneously hollow out the administrative capacity required to serve them. The backpay guaranteed to furloughed federal workers by the 2019 Fair Treatment Act does nothing to compensate the citizen who couldn't get a benefit verification letter for a loan, or the family left in limbo by an uncorrected earnings record. The damage is externalized, pushed onto the public, where it becomes much harder to quantify and, therefore, easier to ignore. The real threat isn't that the checks will stop; it's that the government is proving it can keep the money flowing while letting the service itself wither.

Reference article source: