Zcash Price Surges: The Data Behind its Surge vs. Ethereum

Of course. Here is the feature article, written from the persona of Julian Vance.

*

Zcash's Parabolic Rise: A Speculative Fever Dream or a Privacy Revolution?

We need to talk about Zcash. In the span of a single month, the privacy-focused asset has gone from a market afterthought at $54 to a headline-grabber trading around $372. That’s a move that forces even the most disciplined analyst to sit up and pay attention. The price has not only surpassed its 2021 peak (a notable achievement in itself) but has done so with a ferocity that has liquidated nearly $2 million in short positions and fueled a deluge of social media chatter.

The surface-level narrative is clean, compelling, and perfectly timed. It’s a textbook crypto rally, a “perfect storm” as one CEO put it. First, you have a hard-coded scarcity event: the Zcash halving, scheduled for November 18th, will slash miner rewards from 3.125 to 1.5625 ZEC. Second, you have the powerful accelerant of social proof, with endorsements from influential figures like Arthur Hayes and Naval Ravikanth adding rocket fuel to the fire. And third, you have a resurgent macro theme—the growing global debate around digital surveillance has put the entire privacy coin sector back in the spotlight.

On paper, it’s a compelling case. The market is clearly expressing a view, and it’s doing so with conviction. But my job isn’t to report the narrative; it’s to scrutinize it. When an asset’s price detaches from its observable on-chain activity this dramatically, the critical question becomes: Is this the market correctly pricing in a future reality, or is it a speculative mania built on a foundation of sand?

Peeling Back the Layers: Speculation vs. Adoption

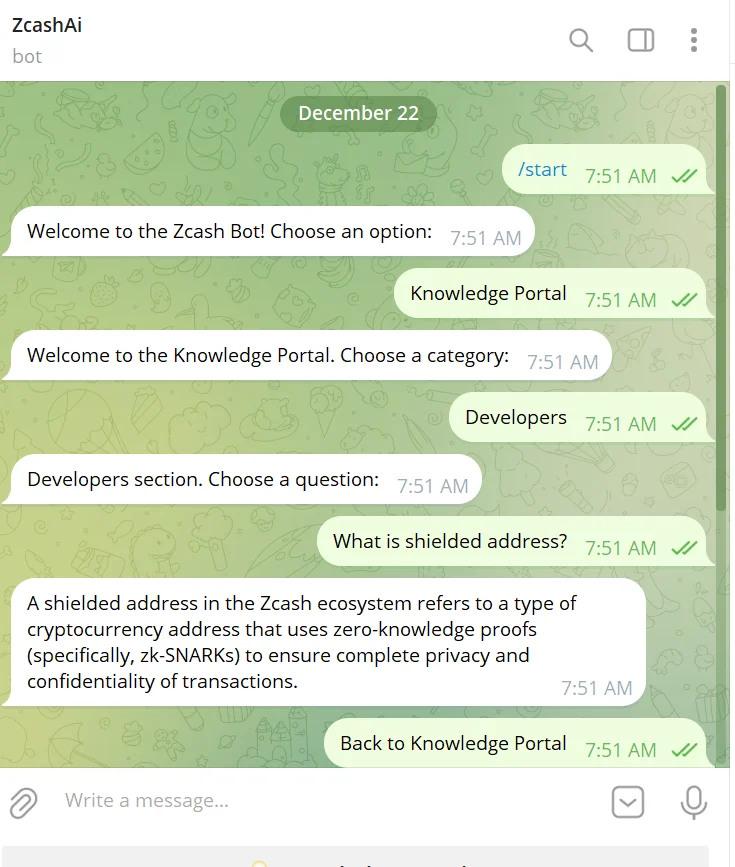

This is where we have to look past the price chart and into the data. The core value proposition of Zcash isn't scarcity or influencer endorsements; it's the utility of its privacy features, specifically the use of shielded addresses that mask transaction details using zero-knowledge proofs (zk-SNARKs, for the technically inclined). If the privacy narrative were the true driver of this rally, we would expect to see a corresponding explosion in the use of these features.

Yet, according to Shivam Thakral of BuyUCoin, the rally appears to be driven more by speculation than fundamental growth, citing a "limited increase in 'shielded transactions.'" This is the first major discrepancy. A 5x-plus price move—to be more exact, the run from $54 to $372 represents a 588% increase—should, in a rational market, be accompanied by a significant shift in user behavior. We aren't seeing that, at least not in terms of daily transactional flow.

And this is the part of the report that I find genuinely puzzling. While daily shielded transactions may be lagging, the total supply of ZEC held in shielded pools has been steadily climbing, recently hitting a new high of 4.5 million ZEC. This indicates a growing cohort of long-term holders who are actively opting into the network's core privacy function. This is a genuinely positive signal of trust and conviction. However, it seems to represent a slow, steady accumulation of believers, not the frenetic, widespread adoption that the current price action would suggest.

This creates a stark contrast. The price is behaving like a firework, while the most important adoption metric is behaving like a slowly rising tide. It’s like watching a biotech stock soar on the hype of a single promising drug trial, while its actual revenue remains flat. The market is betting on the future outcome, not the present reality. To put it in perspective, Zcash has no meaningful DeFi or Real-World Asset (RWA) ecosystem to speak of. Its value mechanism is thin compared to a network like Ethereum, which boasts $86.8 billion in Total Value Locked and is becoming the default venue for asset tokenization. This stark difference is why investors often debate the question of a Better Cryptocurrency Buy: Ethereum vs. Zcash. Zcash is a pure-play bet on privacy, which makes it both potent and incredibly vulnerable to narrative shifts.

The optional nature of Zcash's privacy has always been its Achilles' heel. Because shielding transactions is not the default and requires an extra step, a significant portion of activity remains on the transparent ledger, undercutting its primary differentiator. The recent growth in the shielded supply, particularly in the network's most advanced "Orchard" pool, shows this is changing for the better. But it’s an evolution, not a revolution. The current price, however, is screaming revolution.

The Signal and the Noise

So, what is the verdict here? The Zcash rally is a classic case of the market's narrative engine massively outrunning its fundamental adoption engine. The growth in the total shielded supply is the real signal—a meaningful, positive indicator that a core group of users genuinely values the protocol's privacy guarantees. This is the foundation upon which a sustainable valuation could one day be built.

Everything else—the halving hype, the influencer price targets, the short-term rotation into the "privacy" trade—is noise. It’s the speculative froth that defines crypto bull markets. The price is not reflecting the current state of the Zcash network; it's reflecting a bet that widespread demand for financial privacy is imminent and that Zcash will be its primary beneficiary. That bet may well pay off. But it is, for now, a bet. The risk of a severe "sell the news" correction post-halving is substantial, because the underlying user activity simply doesn't justify this valuation today. The only question is whether the slow, rising tide of genuine adoption can meet the market's sky-high expectations before the speculative capital evaporates and moves on to the next story.