ASML Stock: The Hype vs. The Harsh Reality

So, ASML is up nearly 40% this year. Forty. Percent.

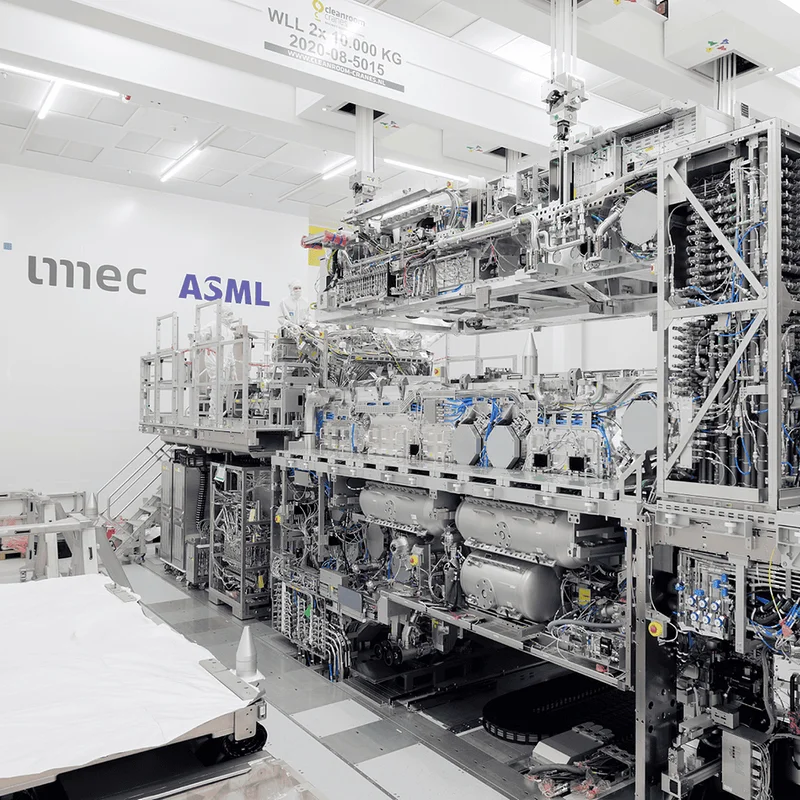

Let that sink in. A company that makes giant, city-bus-sized machines for printing microscopic lines on silicon is outperforming just about every get-rich-quick crypto scheme your cousin tried to sell you on at Thanksgiving. And now, with its next earnings report looming on October 15, the Wall Street hype machine is cranked to eleven.

Everyone’s asking the same question: Is ASML Stock a Buy Before Oct. 15?

That’s the wrong question. The real question is: Have we all collectively lost our minds? The stock is trading at 34 times next year's earnings. Thirty-four. For a company that makes hardware. This isn't some fly-by-night software startup with infinite margins; this is a company that has to actually, you know, build things.

The battle lines are drawn. On one side, you have the "bulls," the true believers who see a world-changing monopoly and think the sky's the limit. On the other, you have people like me—the "bears," I guess—who see a stock price completely detached from reality, floating on a cloud of pure, uncut AI hype.

The Golden Goose and Its One Precious Egg

Let’s be brutally honest. ASML has one thing, and one thing only, that justifies any of this insanity: it’s a monopoly. A pure, grade-A, government-sanctioned monopoly on the most important manufacturing technology on the planet.

I’m talking about Extreme Ultraviolet (EUV) lithography.

Think of it like this: if chipmakers like TSMC, Samsung, and Intel are all chefs in a global cook-off to make the world's most advanced meal (AI chips, 5G modems, etc.), then ASML is the only company on Earth that sells the magical, one-of-a-kind oven required to cook it. Everyone else is trying to bake a five-star soufflé with an Easy-Bake Oven. It just doesn't work.

This is why their sales jumped 30% in 2023. This is why they can command insane prices for their new "high-NA" EUV systems. They are, quite literally, the only game in town. When you have that kind of power, you can get away with a lot. But does that power justify a stock price that has already priced in a decade of flawless execution? And how long can that monopoly truly last when the world's largest superpower is actively trying to build its own oven?

A Memory Shorter Than a Goldfish's

The market seems to have completely forgotten what happened just last year. In 2024, ASML’s sales growth slammed on the brakes, growing a pathetic 3%. Its earnings per share actually fell. The reason? A slowdown in demand for boring old regular chips (you know, the ones in your car and your toaster) and, more importantly, tighter export rules strangling their sales to China.

Now, management is on the record forecasting a glorious comeback for 2025, with 15% sales growth and fat 52% gross margins. The analysts are right there with them, predicting a 25% jump in earnings. It’s a beautiful story. No, "beautiful" doesn't cover it—it's a fairy tale. A fairy tale where the ugly duckling of 2024 magically transforms into a golden swan, all because someone whispered the letters "A" and "I."

Give me a break. Every CEO in the tech sector is doing the same thing. Slap "AI" on a PowerPoint slide and watch your stock pop. It’s the new dot-com bubble, and we’re all pretending we don’t see the cliff just ahead. It’s almost funny, if it weren’t so predictable. I swear, my toaster is going to start advertising its "AI-powered browning algorithm" any day now. But what happens when the AI spending spree cools off? What happens when companies realize they’ve bought a decade's worth of high-powered chips they don’t actually need?

The hangover from that party is going to be brutal. And ASML, for all its monopolistic glory, will be right there with everyone else, nursing a splitting headache.

The Geopolitical Powder Keg

Here's the part of the story that the bulls just love to ignore. ASML is a Dutch company stuck in the middle of a bare-knuckle brawl between the United States and China. Washington has made it crystal clear: ASML is forbidden from selling its best EUV gear to China. Period.

This is like telling Ferrari they’re not allowed to sell cars in California. China is a massive, hungry market, and it’s been permanently walled off for ASML’s highest-margin products. Offcourse, they can still sell older DUV systems, but even those are under tightening restrictions.

Meanwhile, China is throwing ungodly sums of money at developing its own lithography tech. Will they succeed? Who knows. But to assume they’ll just give up and fail forever is arrogant and naive. This geopolitical tension isn’t a temporary headwind; it's the new normal. It’s a permanent ceiling on ASML's growth potential that the current stock price seems to believe just… doesn’t exist. Are investors really pricing in the risk that this tech cold war gets even colder? I seriously doubt it.

This Is a Casino, Not an Investment

Look, I get it. ASML is a phenomenal company, a true marvel of engineering. But the company is not the stock. The stock is a piece of paper whose price is determined by emotion, hype, and a collective suspension of disbelief. Right now, that price reflects a perfect future with zero bumps in the road, zero geopolitical flare-ups, and infinite, unending demand for AI chips.

That future ain't coming.

Buying ASML at these levels isn't investing. It's gambling. It's betting that the hype can outrun reality for just a little while longer. Maybe it can. But I’m not playing. I’ll wait for the October 15 earnings. I’ll wait for the inevitable moment when the AI fever breaks and gravity remembers it exists. Until then, I’ll be watching from the sidelines, popcorn in hand.