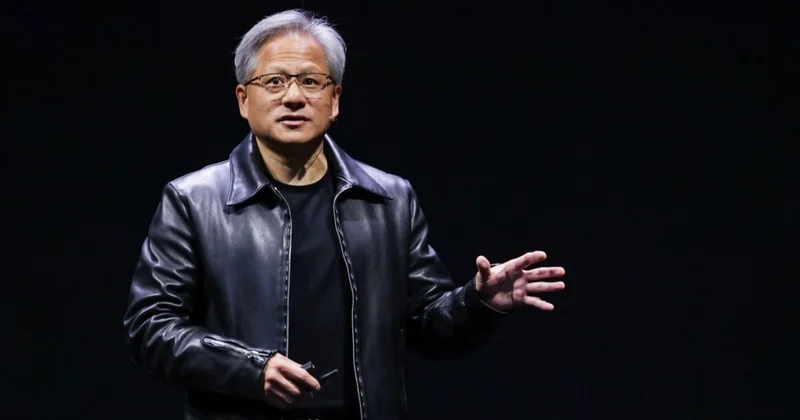

Nvidia CEO Jensen Huang: What's Driving the Stock

GENERATED TITLE:

Jensen Huang's Legend Was Built on Speed. A Stalled UAE Deal Shows Why That's Now a Problem.

*

At the All-In Summit this past September, Arm CEO Rene Haas offered a telling glimpse into the operating system of Nvidia’s Jensen Huang. He recounted a story from his time at the company, a moment when Huang, with a suddenness that bordered on reckless, re-assigned 2,000 engineers. This wasn’t a minor shuffle. At the time, that was a significant portion of the company’s entire engineering workforce—about a third of the total, to be more exact, 33.3%. They were pulled off a stable project supporting Intel processors and thrown at a speculative bet on Arm-based designs and graphics chips.

Haas described the core characteristics of the `ceo of nvidia`—as detailed in Arm CEO on lesson learnt while working under Nvidia founder Jensen Huang: He would change strategy at an - Times of India—as "vision, speed, fearlessness, taking risk, and an ability to pivot very, very fast." That 2,000-engineer gamble is now lore, the foundational decision that paved the way for a $4.59 trillion market capitalization and near-total dominance in AI. The data is clear: Huang’s methodology, a blend of autocratic vision and blistering execution speed, has been monumentally effective. The performance of `nvidia stock` is a testament to that.

But what happens when that velocity collides with an object that doesn’t respond to internal directives or market logic? What happens when the obstacle is the U.S. Commerce Department? A multibillion-dollar deal to supply the United Arab Emirates with advanced AI chips, a cornerstone of a White House initiative to counter China, is now gathering dust, stalled for months. The engine of Nvidia is screaming, but the wheels are stuck in the mud of geopolitics.

The Unmovable Object

The situation is a study in contrasts. Inside Nvidia’s Santa Clara headquarters, one can imagine the low hum of servers processing impossibly complex calculations, the entire building a monument to speed. Yet the most critical variable in this multibillion-dollar equation isn't a technical benchmark; it's a signature from Commerce Secretary Howard Lutnick. The deal, announced with fanfare back in May (and personally touted by President Donald Trump), is now conditioned on the UAE finalizing other U.S. investments and, more critically, on assuaging concerns about its relationship with China.

Private reports, such as Nvidia CEO Jensen Huang Reportedly Frustrated As Trump's Commerce Secretary Slows UAE Chips Deal Over China Link - Yahoo Finance, suggest Jensen Huang and his executive team are deeply frustrated. And this is the part of the data that I find genuinely puzzling: the public posture is a world away from the private reality. An Nvidia spokesperson issued a boilerplate statement affirming support for the Trump administration's AI plans. A senior executive even denied the company was "alarmed." This discrepancy suggests a company accustomed to controlling the narrative suddenly finding itself as a supporting character in someone else’s play.

The core of Huang’s operational genius is his ability to manipulate internal variables with absolute authority. He can move 2,000 engineers with a single command. He is, in essence, a Formula 1 driver who has mastered every aspect of his vehicle and his team, capable of making split-second decisions at 200 miles per hour. Geopolitics, however, is not a racetrack. It’s a traffic jam caused by a diplomatic motorcade, where the rules are opaque, the pace is glacial, and the driver has zero control. The engine can roar all it wants; the car isn’t moving.

Does this impasse represent a temporary bureaucratic hurdle, or does it expose a fundamental blind spot in a corporate strategy forged in the crucible of Silicon Valley meritocracy? Is the legendary Huang playbook, built on the assumption that the fastest and most powerful chip always wins, now obsolete in a world where the flow of silicon is dictated by national security memos?

The Calculus of Risk

Let’s re-examine that 2,000-engineer pivot. It was a calculated risk, but the variables were largely known and quantifiable. Huang was betting on market trends, engineering capabilities, and the trajectory of Moore’s Law. It was a high-stakes wager on technology and commerce, the kind of risk that a visionary CEO is paid to take. He controlled the inputs and could therefore model the potential outcomes with a reasonable degree of confidence.

The UAE deal is a different species of risk entirely. The variables are not technical; they are political, relational, and maddeningly subjective. The approval doesn't hinge on chip performance but on the Commerce Secretary's assessment of the UAE's geopolitical allegiances. There is no datasheet for this, no benchmark to run. Huang can’t deploy more engineers to solve the problem of Washington’s deep-seated anxiety about China.

This isn't just a problem for Nvidia; it's a systemic challenge for a tech industry built on the myth of frictionless globalism. For decades, the primary obstacles were innovation and scale. Today, the map is being redrawn by export controls, entity lists, and strategic rivalries. The very fearlessness that Haas praised in Huang might be a liability when navigating a landscape that rewards caution, patience, and intricate diplomacy.

The skills required to build a world-changing technology company are proving to be starkly different from those needed to navigate its deployment in a fractured world. How does a leader whose entire methodology is predicated on immediate, decisive action adapt when the correct move might be to simply wait? Can a company defined by its ability to "pivot very, very fast" learn the slow, grinding art of the diplomatic long game? The details on how Nvidia is attempting to manage this internally remain scarce, but the external friction is clear for all to see.

A New Variable in the Equation

My analysis suggests that the stalled UAE deal is more than a temporary setback; it’s a market signal. It indicates that the operating environment for frontier technology has fundamentally changed. The very quality that made Jensen Huang a legend—his unparalleled execution speed—is now running headfirst into the one force it cannot outpace: the deliberate, convoluted, and often irrational machinery of state power.

The equation for success in the semiconductor industry now includes a powerful new variable for political risk, and it’s one that can’t be optimized with a better architecture or a faster interconnect. Huang’s genius has always been in seeing the next technical curve and positioning his company to meet it. The challenge now is whether he, and the rest of Silicon Valley, can learn to see the political curves with the same clarity. Because right now, the data shows a collision in progress.