Cook County Property Tax Bills: What's Happening and When Are They Due?

Cook County Property Tax Bills: Decoding the Mystery and Preparing for the Future

Alright, folks, let’s talk about something that gets everyone’s heart racing (and not in a good way): Cook County property tax bills! I know, I know, taxes aren’t exactly the most thrilling topic, but understanding them is crucial, especially when it comes to planning your financial future. And honestly, sometimes it feels like deciphering ancient hieroglyphs, doesn’t it?

I've been diving deep into the questions people are asking – and trust me, there are a lot of them – about everything from due dates to exemptions. It’s clear there’s a real need for clarity, and that’s exactly what I intend to bring.

Navigating the Cook County Property Tax Maze

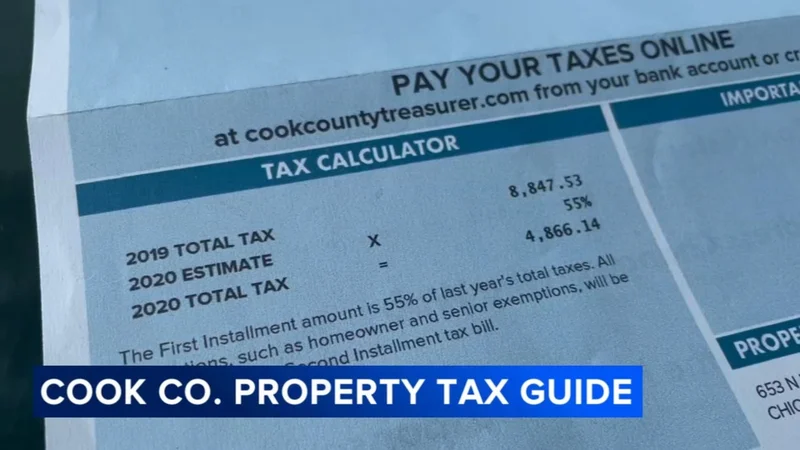

So, what are the burning questions on everyone's minds? I’m seeing a lot of searches around "Cook County property tax second installment 2025" and "Cook County property tax due dates." This tells me people are already thinking ahead, which is fantastic! Planning is everything. The fact that people are searching for the second installment so far in advance shows how top-of-mind this is for people.

Now, I can't give you the exact due dates for 2025 just yet, as those are set closer to the time. But what I can do is help you understand the general timeline and how to stay informed. Think of it like this: understanding the property tax system is like learning to navigate a complex video game. You need to know the rules, the timing, and where to find the cheat codes (aka, exemptions!).

Speaking of exemptions, "Cook County property tax exemption" is another popular search term. This is where things get interesting! Exemptions can significantly reduce your tax bill, and there are several types available, including those for seniors, veterans, and people with disabilities. It’s absolutely worth exploring whether you qualify for any of these. The savings can be substantial, freeing up funds for other investments or, you know, that dream vacation you've been putting off. Why leave money on the table?

And then there's the big one: "When will Cook County property tax bills be mailed?" Patience is a virtue, my friends. Tax bills are typically mailed out a few weeks before the due date. The best way to ensure you don't miss anything is to sign up for email alerts on the Cook County Treasurer's website. Seriously, do it now! It's a small step that can save you a lot of headaches later.

I'm also seeing people searching for "Cook County property tax search." This is a great way to access your property tax information online. You can view your bill, payment history, and other important details. It's all about empowering yourself with knowledge! Think of it as having a direct line to your financial data.

The questions surrounding property taxes are a perfect example of how interconnected everything is, and how each decision has ripple effects.

Conclusion Title: A Brighter, More Informed Future

Cook County property taxes might seem daunting, but with a little knowledge and proactive planning, you can navigate the system with confidence. Stay informed, explore exemptions, and don't hesitate to reach out to the Cook County Treasurer's office if you have questions.

Taking Control of Your Financial Destiny

This is the kind of proactive financial engagement that excites me. Why? Because when we take control of these things, we're not just saving money; we're building a more secure future for ourselves and our families. It's about understanding the system, leveraging the resources available, and making informed decisions that align with our goals. Cook County property taxes can be confusing, but I want you to feel empowered, equipped, and even a little bit excited (yes, excited!) about taking charge of your financial destiny.