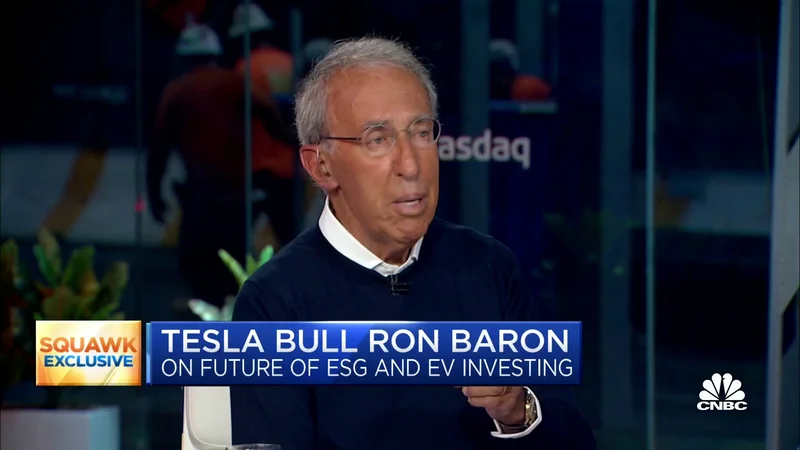

Ron Baron's Tesla Stance: Opportunity or Overconfidence?

Alright, let's talk about Ron Baron and his Tesla obsession. The guy's practically stapled his net worth to Elon Musk's rocket ship, and the question isn't whether he's confident, but whether that confidence is justified by the numbers. We've got Baron out there saying Tesla could be a $10,000 stock within a decade. Bold claim. Let's unpack it.

Baron's Big Gamble: A Portfolio Under the Microscope

Baron's not exactly diversified, is he? Forty percent of his personal net worth in Tesla, another 25% in SpaceX. (That's 65% in two companies both run by the same guy.) Then another 35% in his own Baron mutual funds. (Which, presumably, have at least some exposure to Tesla as well.) I mean, respect for conviction, but it's a concentrated bet.

He claims he's already made $8 billion on a $400 million initial investment. That's a 20x return, which is frankly insane. But past performance isn't a guarantee of future results, as the saying goes (and it's a saying for a reason).

Baron's argument hinges on Tesla's potential beyond EVs, specifically Optimus, the humanoid robot. He quotes Musk saying Optimus could be Tesla's most valuable product line. Baron claims Tesla is building production capacity for one million robots next year and 10 million the year after that. This is where I get a little skeptical.

Where are those numbers coming from? I've dug through Tesla's filings, and while they talk about Optimus, I don't see any concrete production targets of that magnitude. It's all very aspirational. (Maybe Baron has inside information, but I'm working with what's publicly available.)

The Optimus Factor: Hype vs. Reality

Let's assume, for a moment, that Baron's right about the robot production numbers. One million robots next year, 10 million the year after. What's the addressable market for humanoid robots? Who's going to buy them? What will they do? This is the part of the report that I find genuinely puzzling. Tesla's got a lot of competition in the robotics space, and most of those companies are focused on industrial automation, not human-like robots.

And let's be real, the "multibagger run" he's predicting? That requires a level of growth that's almost unheard of for a company of Tesla's size.

The consensus among Wall Street analysts is a "Hold" rating, with an average price target implying a 5.58% downside from current levels. That's based on 14 "Buy," 10 "Hold," and 10 "Sell" recommendations. (A pretty divided opinion, it seems.)

I will say, Baron’s been right about Tesla for a long time. He's held the stock for over a decade, and he's made a fortune. But the market's changed. Competition's heating up. And the easy money's probably already been made.

Is This Conviction or Just Overconfidence?

Baron's bet on Tesla is a high-stakes game. It's either a stroke of genius or a case of overconfidence blinding him to the risks. The data suggests it's probably somewhere in between. Tesla has potential, sure, but the $10,000 price target? That seems like a stretch. He's betting his legacy on Elon Musk, and that's a bet that could pay off big, or it could end up costing him everything.