Solana's Crypto Plunge: What Happened and Why

[Generated Title]: Solana's Dip: Profit-Taking or a Sign of Deeper Troubles?

Solana (SOL) is down. The headline isn't exactly earth-shattering; crypto's known for its volatility. But an 8.7% drop in 24 hours (as of 2:45 p.m. ET on November 4, 2025) and a near 17% loss for the week? That gets the attention of even the most seasoned traders. Is this just a blip, a chance to buy the dip, or something more ominous?

The liquidations data offers a clue. A whopping $277.4 million in long positions on Solana perpetual futures were liquidated, dwarfing the $33.3 million in short liquidations. That’s a greater than 8x difference. This suggests a significant number of traders were caught leaning too heavily on Solana’s continued upward momentum. The broader crypto market also took a hit, down over 3.5% in the same period, so Solana wasn't alone in its woes.

Profit-Taking and Market Sentiment

Here's where the narrative gets interesting. The launch of new spot Solana ETFs has been met with considerable enthusiasm, drawing in hundreds of millions in investment. Typically, that kind of influx would be a bullish signal. So why the sell-off? The obvious answer is profit-taking. Investors who got in early on Solana (at significantly lower prices) are likely using the ETF-driven surge as an opportunity to realize gains and rotate capital into other assets. It’s a classic "buy the rumor, sell the news" scenario playing out in real-time.

But, and this is the part of the report that I find genuinely puzzling, look at the chatter. Some corners of the crypto community are talking about diversifying away from Solana. Now, online sentiment is hardly a perfect indicator, but it provides anecdotal evidence of a shift in thinking. Is it a full-blown exodus? Hardly. But it does raise a question: are people losing faith in Solana's long-term prospects, or are they simply rebalancing their portfolios?

The "Stuff Happens" Blockchain

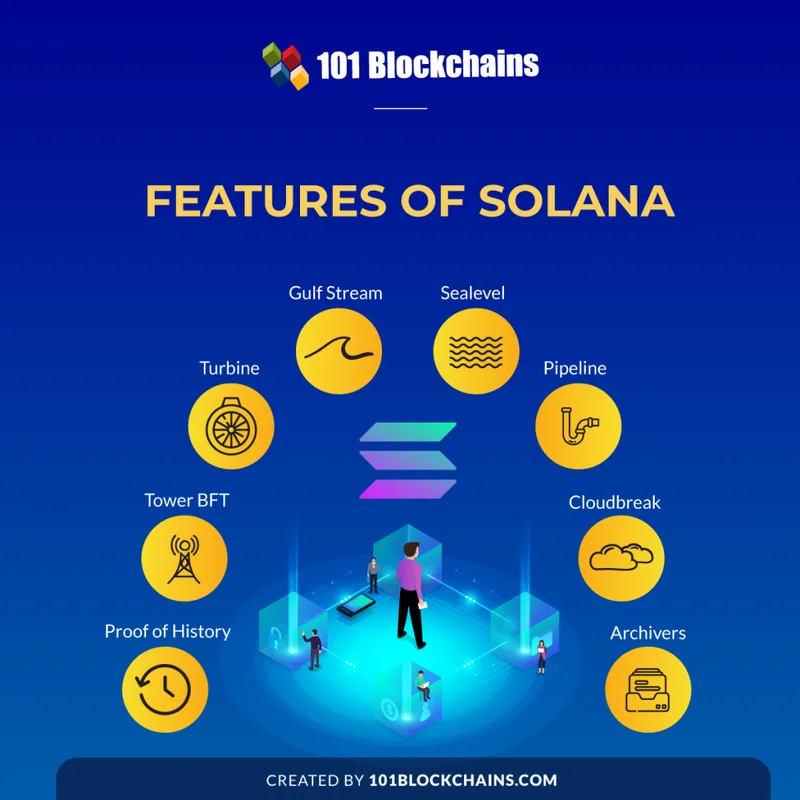

Solana has a reputation as the blockchain where “stuff actually happens.” It’s a leading platform for developers and users alike, thanks to its speed and low transaction costs. This isn't just marketing fluff; the network activity backs it up. But that activity also comes with a cost: volatility. Solana's history is riddled with price swings, both up and down. It’s the price you pay for being on the cutting edge.

The critical question is whether this dip represents a fundamental shift in Solana's trajectory or just another bump in the road. The launch of the ETFs suggests long-term confidence in the asset. But the liquidation data and the murmurs of diversification suggest a more nuanced picture. Perhaps investors are realizing that even the fastest blockchain with the lowest fees isn't immune to market cycles and risk management.

Time to Re-Evaluate, Not Panic

So, what's the real story? It's likely a combination of factors. Profit-taking is undoubtedly playing a role. But the shift in sentiment, however subtle, shouldn't be ignored. Solana's long-term potential remains strong, but investors need to be realistic about the risks. A 17% weekly loss isn’t the end of the world (especially in crypto), but it’s a reminder that even the most promising assets require careful monitoring and a healthy dose of skepticism. (Remember that time Dogecoin went up 400% in a week? Yeah, don't chase pumps.)