QQQ Stock: The Cash Flow Collapse

Title: QQQ's Hidden Time Bomb: Margin Math Doesn't Lie

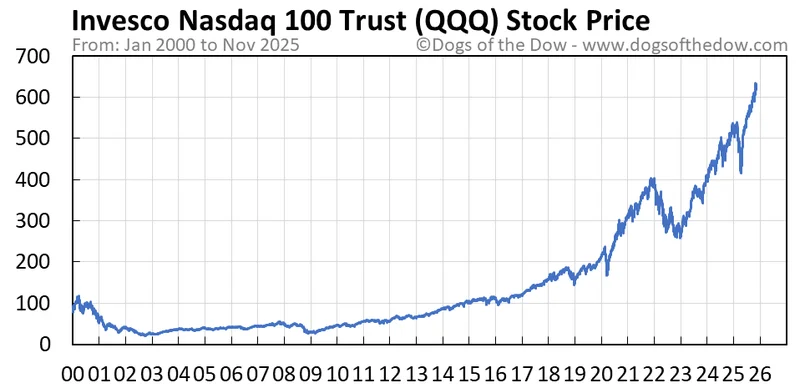

The Invesco QQQ Trust (QQQ), tracking the Nasdaq 100, has been a rocket ship, especially with the AI boom. But beneath the surface, some worrying trends are developing. While reported earnings paint a rosy picture, a closer look at profit margins reveals a potential time bomb.

The Margin Mirage

One article I scanned mentioned that the Nasdaq-100 typically outperforms the S&P 500, fueled by technologies like AI. True enough, the top holdings in QQQ – Nvidia, Apple, Microsoft, Alphabet, and Broadcom – have seen median returns of 218% since the AI surge began in 2023. That's impressive, no doubt. The article goes on to say that the Invesco QQQ ETF has delivered a compound annual return of 10.6% since it was established in 1999. But what if that growth is unsustainable?

The problem isn't revenue growth; it's profit growth, or rather, the lack thereof. As Icon Economics has pointed out, profit margins among the Nasdaq 100 have been declining over the past decade. Now, here's the kicker: on a reported earnings basis, margins appear to be expanding. How is that possible?

It's all about depreciation. Reported depreciation expenses are masking the underlying weakness in true profitability. Companies are depreciating assets in a way that inflates their apparent earnings, creating a mirage of financial health.

Why is this happening? Well, accelerated depreciation schedules (allowed by tax laws) can make companies look more profitable in the short term. But that's just kicking the can down the road. Eventually, those assets need to be replaced, and the inflated earnings will come crashing back to reality.

AI's Capital Conundrum

This margin squeeze is particularly concerning in the AI sector. Remember the recent mini-panic when OpenAI's CFO hinted at a potential capital shortfall? (She quickly retracted it, but the market's reaction was telling.) The article mentioned that the eight largest AI stocks have lost a combined $911 billion in market capitalization since last Friday. That's a lot of value evaporating.

The fear is that the AI boom is built on unsustainable levels of capital expenditure. Companies are pouring billions into developing AI infrastructure, but are those investments translating into real, sustainable profits? Or are they simply fueling a depreciation-driven earnings illusion?

I've looked at hundreds of these filings, and the level of capital expenditure being written off as depreciation in some of these AI companies is genuinely eye-watering. We're talking about amortizing server farms and specialized hardware that might be obsolete in just a few years. The real question is: are these companies generating enough real cash flow to justify these massive investments, or are they simply borrowing from the future?

And this is the part that I find genuinely puzzling. The market seems to be ignoring this discrepancy between reported earnings and underlying cash flow. Are investors simply blinded by the hype surrounding AI? Or are they deliberately choosing to overlook the warning signs?

The University of Michigan's preliminary Index of Consumer Sentiment for November came in at 50.3, just barely above the all-time low. "Consumer sentiment fell back about 6% this November, led by a 17% drop in current personal finances and a 11% decline in year-ahead expected business conditions,” said Surveys of Consumers Director Joanne Hsu. If consumers are pulling back, how long can this tech-fueled market rally continue? Stock Market News Review: SPY, QQQ Bounce Back from Tech Selloff as Consumer Sentiment Plunges

The Long View

Now, to be clear, I'm not saying that the AI revolution is a complete sham. AI is real, and it has the potential to transform industries. But the current market valuations of many AI companies seem detached from reality. They're priced for perfection, with little room for error.

The Invesco QQQ ETF may have delivered impressive returns in the past (10.6% annually), but past performance is no guarantee of future results. The ETF's heavy concentration in tech (specifically AI) makes it particularly vulnerable to a correction if the AI bubble bursts.

The article mentioned that the Nasdaq-100 has experienced three bear markets in the last five years alone, triggered by various events like the COVID-19 pandemic and interest rate hikes. Each time, the market bounced back. But what if this time is different? What if the underlying problem – declining profit margins masked by depreciation – is more structural than cyclical?

The Hype Doesn't Match the Math

The QQQ is priced for a future that may never arrive. A dose of skepticism, and a hard look at the numbers, is warranted.