vix: what happened and why

Is the VIX Just Wall Street's Odometer?

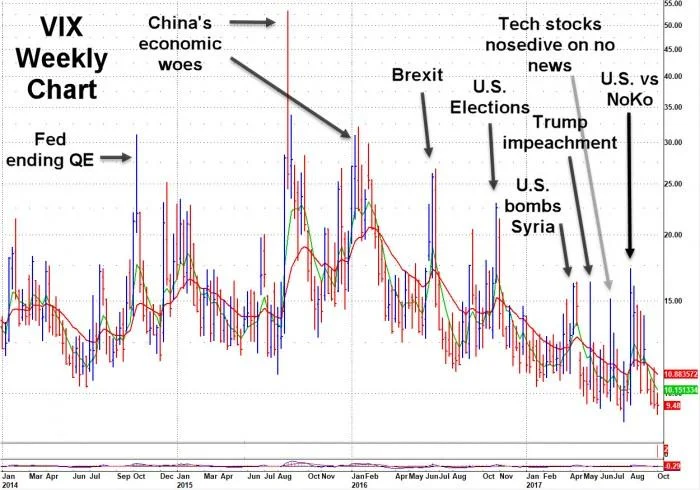

Okay, so Cboe Global Markets is still pushing data on the VIX index, huh? The "world's premier gauge of U.S. equity market volatility." Give me a break. More like the world's premier gauge of how much Wall Street wants to charge you for fear.

Decoding the Fear Factor

Let's be real: the VIX is supposed to tell us how scared investors are, right? It's all based on S&P 500 options – puts and calls, strike prices, all that jazz. They claim it's some kind of magic formula cooked up with Goldman Sachs back in '03. As if that pedigree inspires confidence. I mean, Goldman Sachs helping to define market volatility? That's like letting a fox design the henhouse security system.

And what's the point of even tracking this stuff? Are we supposed to make better decisions because some algorithm spits out a number that supposedly quantifies "fear"? Please. It's just another excuse for hedge funds to sell overpriced insurance.

I love this line from Cboe: "The new VIX Index is based on the S&P 500® Index (SPX®), the core index for U.S. equities..." Core index? More like the manipulated index.

Don't even get me started on the VXO, the "original version" based on the S&P 100. So, they changed the formula, naturally. Because the old one wasn't making enough money for somebody? Probably.

The Illusion of Control

Here's the thing that really grinds my gears: this whole volatility index thing is built on the illusion that you can predict, or at least measure, the unpredictable. It's like those weather apps that promise pinpoint accuracy three weeks out. We all know how that usually turns out.

And the data? Cboe says it's "compiled for the convenience of site visitors" but then immediately covers their asses by saying they’re not responsible for accuracy. So, basically, they're saying "Here's some data! Good luck! Don't sue us!"

What are we supposed to do with this information? Day trade based on millisecond fluctuations in the VIX? Invest based on the collective anxiety of a bunch of algorithms? It all feels like a giant, self-fulfilling prophecy, where the VIX itself creates the volatility it's supposed to measure.

Offcourse, the real question is: who actually uses this stuff besides high-frequency traders and financial news outlets looking for a scary headline? Are regular investors really making informed decisions based on the VIX? Or are they just getting played?

The Emperor Has No Clothes

Cboe also calculates a bunch of other volatility indices. Dozens, apparently. Each one probably more useless than the last. I tried to find some actual news or analysis related to the VIX, but the link I found just led to a dead page on Headline News Summaries, World News, and Breaking News. Apt, really. Says it all.

It's all smoke and mirrors. A way to extract fees from the market by selling a product nobody truly understands or needs. It's the financial equivalent of selling bottled air.

So, What's the Real Story?

The VIX ain't a "gauge of fear." It's a gauge of Wall Street's ability to profit from that fear. And honestly, I'm not sure which is scarier.