TQQQ Explained: How It Works and Why It's a Game-Changer for Tech Investing

Generated Title: TQQQ Is Up 35%, But the Real Story Is Why It's Not 52%

I was looking at the market charts the other day, and something jumped out at me—something that tells a fascinating story about the very fabric of our technological age. The ProShares UltraPro QQQ, a fund you probably know by its ticker, TQQQ, is up a staggering 35% so far this year. When I first saw that number, I honestly just sat back in my chair, speechless. In a world where a 10% annual return is considered a home run, 35% in just over nine months feels like a paradigm shift.

This isn't just any fund. TQQQ is designed to be a direct bet on the engine of human progress: the Nasdaq-100. We're talking about the titans—NVIDIA, Microsoft, Apple, Amazon. These aren't just companies; they are the architects of our future, building the AI, the cloud infrastructure, and the digital platforms that will define the next century. Investing in the Nasdaq-100 is a statement of faith in that future. But investing in TQQQ? That’s something else entirely. It’s a declaration that you believe the future isn't arriving fast enough.

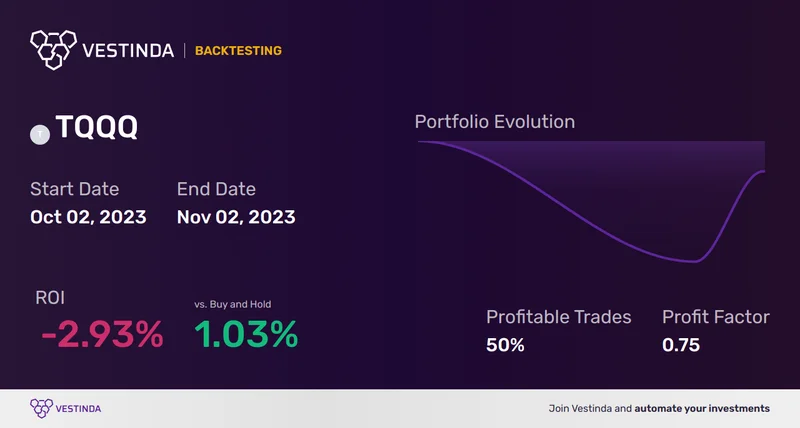

But here’s where the story gets truly interesting. TQQQ’s stated goal is to deliver three times the daily return of the Nasdaq-100. The index itself is up a very healthy 17.4% this year. Now, do the quick math. Three times 17.4% is 52.2%. So why the gap? Why is TQQQ "only" up 35%? The answer reveals a profound truth not just about finance, but about the cost of acceleration itself.

The Physics of Financial Velocity

To understand TQQQ, you have to think of it less like a traditional investment and more like a high-performance vehicle. It’s built for speed, using a mechanism called leverage—in simpler terms, it uses borrowed capital and derivatives to amplify its exposure to the market. Its objective is to give you three times the Nasdaq-100’s performance, but here’s the crucial fine print: it does so on a daily basis.

Every single day, the fund resets. If the Nasdaq-100 goes up 1%, TQQQ aims for a 3% gain. If the index drops 1%, TQQQ takes a 3% hit. This daily rebalancing is the source of its incredible power, but also its hidden drag. This brings us to a beautiful, almost poetic concept known as "volatility decay."

Imagine you're trying to cross a lake in a speedboat. The Nasdaq-100 is a steady cruiser moving in a straight line toward the other shore. TQQQ is your speedboat, capable of going three times faster. On a perfectly calm day, you'll get there in a third of the time. But the market is never a calm lake; it's a choppy ocean. The daily ups and downs are the waves. Your speedboat gets tossed around—up 3% one day, down 3% the next. Each of these violent swings, even if they ultimately cancel each other out in the underlying index, forces your speedboat to burn extra fuel and lose momentum. This constant, frantic correction is volatility decay. It's the friction generated by speed, the price you pay for trying to move faster than the world around you.

This is why the long-term math doesn't add up to a simple 3x. The path of TQQQ is a jagged, frenetic line drawn around the smoother arc of the index it tracks. The sheer speed of this is just staggering—it means the gap between a good day and a bad day is amplified into a chasm, and the energy lost in navigating that volatility is what accounts for the difference between the 52.2% you'd expect and the 35% you actually get. So, does this make it a flawed instrument? Or does it just make it a tool for a very specific purpose?

Riding the Lightning

This brings us to the human element. A tool this powerful demands not just intellect, but wisdom. It’s the financial equivalent of the early days of aviation. The Wright brothers’ Flyer could achieve the miracle of flight, but it was an unstable, dangerous machine that required a master's touch. It wasn't meant for a casual passenger looking for a comfortable ride. Similarly, TQQQ isn't a "buy and hold" treasure chest you stick in a drawer for 20 years. It’s a tactical instrument for short-term conviction.

The very existence of a product like TQQQ, and its immense popularity, is a signal of the times we live in. We are witnessing an exponential curve of technological progress, and there's a palpable sense of impatience in the air. We see the promise of AI, of bio-engineering, of decentralized networks, and we want to get to that future now. TQQQ is an expression of that collective desire, a way to place a high-octane bet on near-term breakthroughs.

But this is where we have to pause and consider our responsibility. When you wield a tool that amplifies both gains and losses, you are also amplifying emotion. You're amplifying the thrill of victory and the panic of a downturn. Holding TQQQ through a market dip is an exercise in psychological endurance. That's why the wisest voices in this space recommend keeping positions small, using it for defined periods, and understanding that you are truly riding lightning.

What does it say about us that we've built financial tools that mirror the exponential, volatile, and awe-inspiring nature of technology itself? Are we simply creating instruments that reflect our own growing impatience for the world of tomorrow? Or are we learning to harness volatility as a force of nature, much like we learned to harness wind and electricity?

The Acceleration Engine

When you strip it all away, TQQQ is more than just an ETF with a complex formula. It’s a philosophical statement. It’s a bet that the future we see coming—the one powered by the silicon brains at NVIDIA and the global networks of Amazon and Microsoft—is not only inevitable, but imminent. The 0.82% expense ratio and the drag from volatility decay aren't flaws; they are the price of admission for a seat in the cockpit of a rocket ship. It’s a flawed, beautiful, and dangerous tool, perfectly suited for an era defined by the same qualities. It’s for those who don’t just want to invest in tomorrow, but want to get there three times as fast.