Dow Jones Futures Signal a New Rally: The Forces Driving This Surge and What It Means for Tomorrow

Of course. Here is the feature article, written from the persona of Dr. Aris Thorne.

*

The headlines are screaming, aren't they? Dow 47,000. S&P 500 up an incredible 36% in just over six months. It’s the kind of rally that makes cynics nervous and optimists giddy, a debate captured by the central question: Think the stock rally is over? It may just be beginning. The financial news cycles are churning out the usual narratives: Federal Reserve rate cuts, resilient consumer spending, geopolitical drama with US-China trade talks. And yes, all of that is part of the story. But it’s not the story.

What we are witnessing right now isn't just another bull market. It’s not just a sugar high from cheap money or a classic case of FOMO, though analysts are quick to point to those "fumes." I believe we're seeing something far more profound. We're witnessing the first major economic shockwave of a technological paradigm shift. This isn't a bubble built on speculation; it's the market attempting, clumsily and frantically, to price in the dawn of the AI age.

Think about it. The so-called "Magnificent Seven" tech stocks have accounted for a staggering 41% of the S&P 500's entire gain this year. This isn't a broad, indiscriminate rally where every company is lifted by a rising tide. This is a concentrated, almost violent, reallocation of capital toward the companies that are building the very infrastructure of our future. When I see Nvidia’s earnings or the AI integrations Microsoft is pushing out, I honestly just sit back in my chair, speechless. This isn't just about making better spreadsheets or search engines; it’s about laying down the fundamental architecture for the next fifty years of human progress.

What we’re seeing is a market that has finally started to understand the sheer scale of what’s coming. The question isn't whether the market is overvalued. The real question is: how do you even begin to value a revolution?

The New Industrial Revolution

I hear the whispers of caution, and we should listen to them. Bob Doll at Crossmark Global Investments calls this a "high risk bull market," and he's not wrong. Valuations are stretched. The labor market is showing cracks. President Trump’s tariff threats create a constant hum of uncertainty. These are real risks, like choppy seas on a transatlantic voyage. But they are surface-level phenomena. The deeper current, the one that's truly propelling the ship forward, is the unstoppable force of technological innovation.

This isn't the dot-com bubble of the late 90s. That was a boom built on promises, on "eyeballs" and speculative business models for a technology whose infrastructure was still in its infancy. This is different. This is more akin to the dawn of the railroad era. Back then, the market wasn't just betting on the idea of a train; it was pouring money into the companies laying the steel tracks and building the engines. The value wasn't in the promise of connecting the country, but in the tangible creation of the network that would make it possible.

Today, companies like Nvidia, Microsoft, and Alphabet aren't just selling a dream of AI. They are building the "rails." They are manufacturing the chips, developing the large language models, and creating the cloud infrastructure—the digital steel—that every other industry will soon depend on. The latest earnings reports confirm this, with 86% of S&P 500 companies that have reported so far beating expectations, driven by what JPMorgan analysts call "above trend growth" from AI.

What does "above trend growth" really mean? In simpler terms, it means these companies aren't just growing a little faster than the rest of the economy—they're operating on a completely different growth curve, one powered by the exponential logic of technological progress itself. People are worried about today's valuations, but when you have a technology that can fundamentally reshape every industry from medicine to logistics, the old models for valuation start to break down because you're not just pricing in next year's earnings, you're trying to price in an entirely new economic reality and that's a monumental, almost impossible task.

Beyond the Ticker Tape

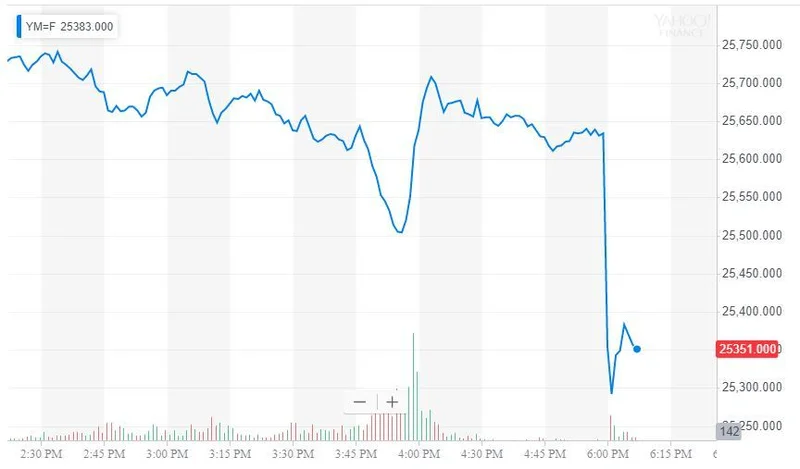

It’s easy to get lost in the day-to-day noise. One day the Dow drops 900 points on a tariff threat; two weeks later it’s at a new record high. This volatility is the market’s anxiety showing. It's grappling with a future that is arriving faster than our linear minds can fully process. But if you zoom out, the trajectory is unmistakable. We are moving toward a world where intelligence itself is a utility, as accessible as electricity. What does that mean for productivity? For creativity? For human potential?

This is where we, as technologists and investors and citizens, have a profound responsibility. The capital flowing into these companies is more than just money; it’s a mandate. It’s a collective bet on a vision of the future. And with that investment comes an ethical obligation to ensure this powerful technology is steered toward human flourishing. This can't just be about shareholder returns; it has to be about building a more intelligent, more efficient, and more equitable world. The potential is immense, but so are the stakes.

So when you see the market hit another record, try to look past the numbers on the screen. See it for what it is: a signal. It’s the sound of capital rushing to fund the construction of a new world. It’s messy, it’s chaotic, and it’s fraught with risk. But it’s also filled with the most incredible promise. We are at the very beginning of the steep part of the curve, and the journey from here is going to be one of the most exciting in human history. The real question isn't "is the rally over?" It's "do we truly comprehend what's just beginning?"

This Isn't a Bubble, It's a Launchpad

Let’s be clear. The fear, the skepticism, the constant search for the pin that will pop this "bubble"—it all comes from applying old-world thinking to a new-world reality. This isn't just a market cycle. It's a technological phase change. The financial system is simply the first institution to react to the tremors of a tectonic shift in human capability. The gains we're seeing aren't the peak; they're the down payment on a future that will be built on a foundation of artificial intelligence. We're not at the end of a rally. We're at the beginning of a renaissance.