The Pfizer Stock Gamble: Unpacking the Sudden Rebound and Why It Won't Last

Let's get one thing straight. Every time a legacy behemoth like Pfizer has a good week, Wall Street analysts crawl out of the woodwork to tell you it’s the start of a grand turnaround. They did it in late September when Pfizer’s stock jumped 15% in a week, and they’ll do it again if the earnings report on November 4th doesn't completely tank.

But I’ve been watching this dog of a stock limp along for years. It’s been down nearly 30% over the last five. So when I see a sudden burst of optimism, my first instinct isn't to buy. It’s to ask: who’s getting played here?

The White House Two-Step

First, you have the "landmark agreement" with the Trump administration. Give me a break. Pfizer, a company that has made billions from the American healthcare system, agrees to lower some drug prices for Medicaid—prices they probably inflated to an absurd degree in the first place. In return, they get to dodge a 100% tariff bullet. The press release practically glows with self-congratulation. You can just picture the stiff handshakes and forced smiles at the announcement, everyone patting themselves on the back for solving a crisis they all helped create.

Analysts called it a "win-win" that removes "political risk." A win-win? For who, exactly? Pfizer gets a PR victory and tariff relief. The White House gets to claim they're tough on Big Pharma. And the American public? We get a slightly less obscene price on a handful of drugs while the fundamental racket remains untouched. It’s like watching two mob bosses agree not to burn down each other’s warehouses this week and calling it a victory for public safety.

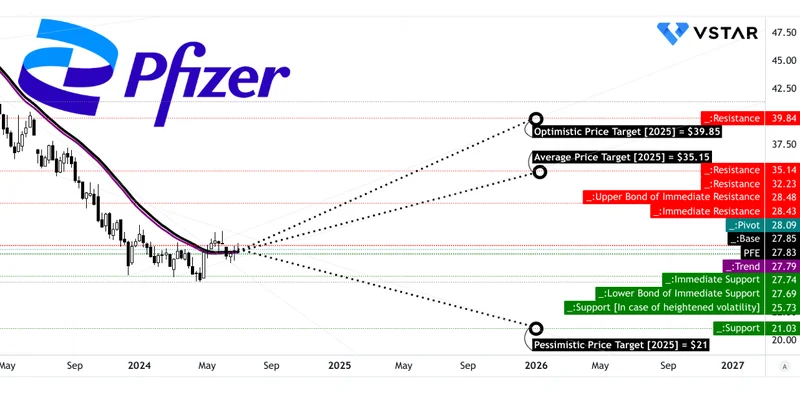

This deal didn't fundamentally change Pfizer’s business. It was a calculated move to get a political headache off their backs. The stock rallied because the market hates uncertainty more than it hates anything else. But now that the dust has settled, PFE is right back in the mid-$20s, where it’s been languishing. So, was that a sign of a real comeback or just a dead cat bounce fueled by a Beltway photo-op?

Chasing the Skinny Jean Trend

Then there’s the big, splashy $7.3 billion bet on Metsera to jump into the weight-loss drug craze. This is Pfizer acting like an aging rock band that sees some new synth-pop trend taking over the charts and decides to buy a bunch of keyboards. They tried and failed with their own GLP-1 drug, so now they’re just buying their way back into the game.

It's a smart move. No, 'smart' doesn't cover it—this is a desperate move. Eli Lilly and Novo Nordisk are already printing money with Zepbound and Ozempic. They own this market. Pfizer is showing up to the party fashionably late, hoping to convince everyone they were cool all along.

Sure, Metsera’s early data looks promising—14% weight loss, on par with the big boys. Wall Street is calling Pfizer a "budget entry-point" to the obesity boom. That sounds nice, but it’s just a polite way of saying, "Here's a cheap stock that might get a piece of a market someone else created." There are years of clinical trials and regulatory hurdles ahead. What happens if Metsera’s drug hits a safety snag, just like Pfizer’s last attempt? What if, by the time it launches in 2027, the market is saturated or a newer, better treatment is already on the horizon? Pfizer is betting billions that they can catch a wave that’s already cresting. It’s a huge gamble, and honestly...

The Siren Song of a 7% Dividend

When a company’s stock is this beaten down, they always dangle the same shiny object in front of investors: the dividend. Pfizer’s is a juicy 7%. That’s the kind of yield that makes income investors drool. It’s a promise that says, "Hey, even if the stock goes nowhere, we’ll pay you to wait."

But a high dividend on a stagnant stock can also be a warning sign. It’s often a company’s way of bribing shareholders to stick around while the core business erodes. The stock trades at a dirt-cheap 8 times forward earnings, half the industry average. The bulls call this "undervalued." I call it being priced for mediocrity. The market ain't stupid; it knows about the looming patent cliffs for blockbusters like Eliquis.

Is Pfizer a "value trap"? That’s the billion-dollar question. The company isn’t going bankrupt, offcourse. It’s a cash-generating machine with a solid oncology pipeline thanks to the Seagen acquisition. But it’s also an aircraft carrier trying to make a hairpin turn. It’s cutting $4 billion in costs to fund all these new ventures, which tells you they’re trying to patch holes while building a new engine at the same time. Then again, maybe I'm just too cynical. Maybe this time it's different.

But history rarely lies. For years, every positive earnings report has done little to stop the stock's slow, grinding descent. Why should this one be the magic bullet?

This Looks Awfully Familiar

So here we are, staring down the barrel of another earnings report. The narrative has been set: political risk is gone, a big bet on obesity is in place, and a fat dividend is your reward for patience. It’s a tidy little story that has led to headlines like Pfizer (PFE) Stock Rebounds on Trump Drug Deal & Obesity Gamble – Can the Rally Last? A little too tidy, if you ask me. It feels less like a genuine turnaround and more like a carefully managed PR campaign to change the subject from years of underperformance. I’m not saying it’s impossible for Pfizer to pull this off, but I’ve seen this movie before. And it usually ends with the credits rolling over a flat stock chart.